A genuine buyer cannot be deprived of Input Tax Credit and instead recovery action should be taken against the defaulting supplier

ITC is ineligible where there is delay in filing GSTR 3B beyond the time limit prescribed under Section 16(4) of the CGST Act

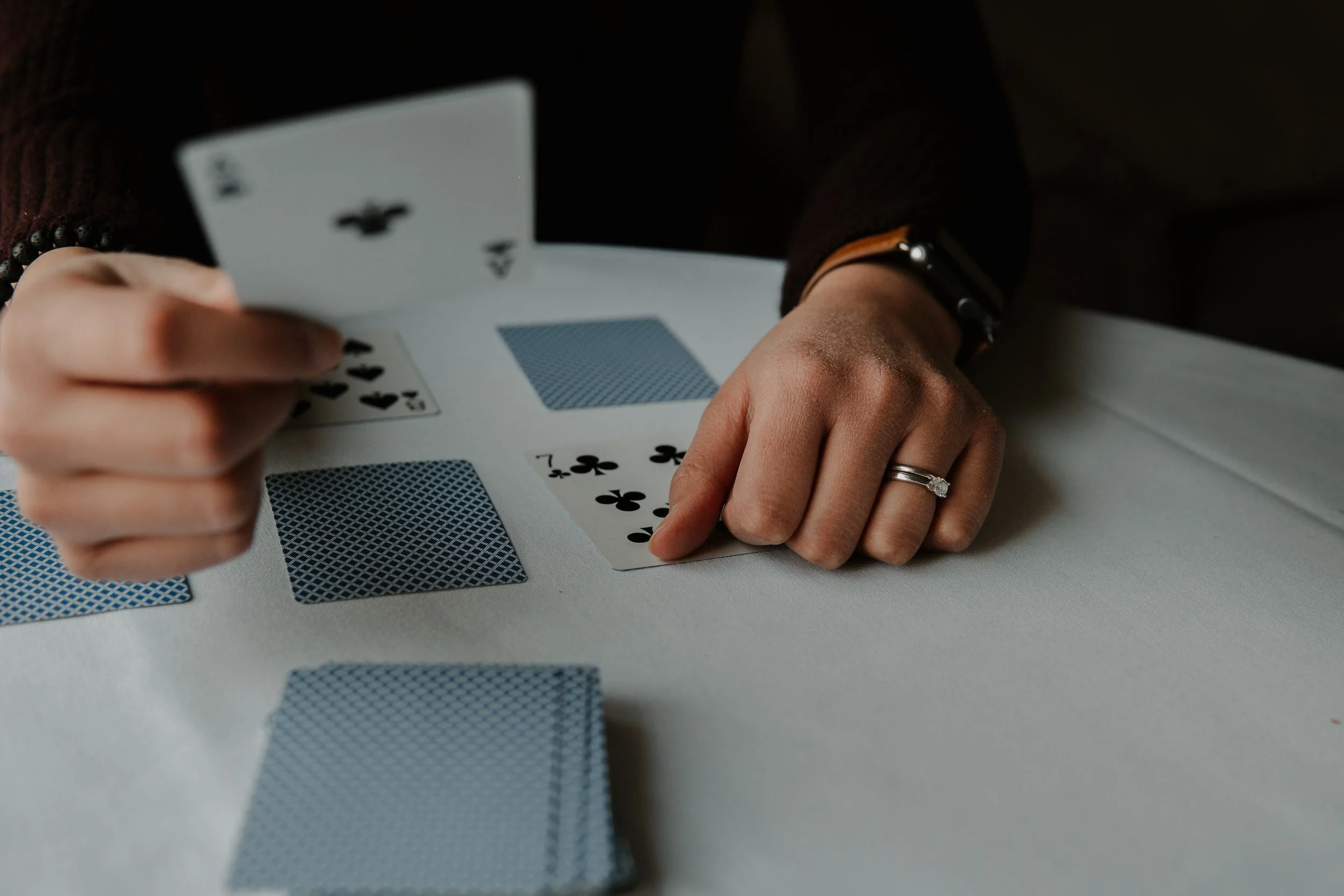

Entry 6 of Schedule III of the CGST Act provides that lottery, betting, and gambling are subject to GST, while other actionable claims are not.

Gujarat AAR holds that the sale of over-the-counter readily available food and beverages qualify as a supply of goods and not restaurant services

Recent amendments in the GST Rules, and clarifications issued by CBIC pursuant to the 48th GST Council meeting